Feb 27, 2023Check out LLC taxed as Sole Proprietorship for more details. To start an LLC in California, you need to file the Certificate of Formation with the Secretary of State and pay a $200 filing fee. A Limited Liability Company must also pay an LLC annual fee and appoint a Registered Agent in order to stay in compliance.

Sole Proprietorship vs LLC in California – San Diego Corporate Law

Nov 25, 2022Sole proprietorship in California. Sole proprietorships are unincorporated and owned by one person. They’re best suited for smaller businesses with no (or few) employees. Keep in mind, you are not separate from your business. So, while 100% of the profits go to you, you are also 100% responsible for your business’s liabilities.

Source Image: startupsavant.com

Download Image

A sole proprietorship is simply a Business-of-One. One owner, you, who gets all the assets and profits and takes responsibility for the taxes. It’s the most common way to structure a business if you’re a freelancer, consultant or small business offering services to clients. But it’s not always the best business structure.

Source Image: sdcorporatelaw.com

Download Image

The 4 Most Popular Types of Businesses and How To Choose One – Shopify Indonesia Obtain An Employer Identification Number (EIN) 1. Choose A Business Name. In California, a sole proprietor has the option to use either their legal name or a trade name, also referred to as a “fictitious business name” (FBN) or “doing business as” (DBA), for conducting their business. However, if you decide to use an FBN or trade name

Source Image: m.youtube.com

Download Image

How To Set Up A Sole Proprietorship In California

Obtain An Employer Identification Number (EIN) 1. Choose A Business Name. In California, a sole proprietor has the option to use either their legal name or a trade name, also referred to as a “fictitious business name” (FBN) or “doing business as” (DBA), for conducting their business. However, if you decide to use an FBN or trade name They are easy to set up and, for this reason, are popular amongst solo entrepreneurs and startups. Unlike business structures like Limited Liability Companies (LLCs) or corporations, there is no legal separation between the business and the owner. … A step-by-step guide to starting your California sole proprietorship. 1. Choose a business name.

How to Start a Sole Proprietorship in 2023 | Rob.CPA – YouTube

In this video I share the 9 steps to set up your sole proprietorship small business in Calif… Are you looking to start your one-person business in California? In this video I share the 9 steps Sole Proprietorship vs LLC vs C Corp for App and Website Development – TermsFeed

Source Image: termsfeed.com

Download Image

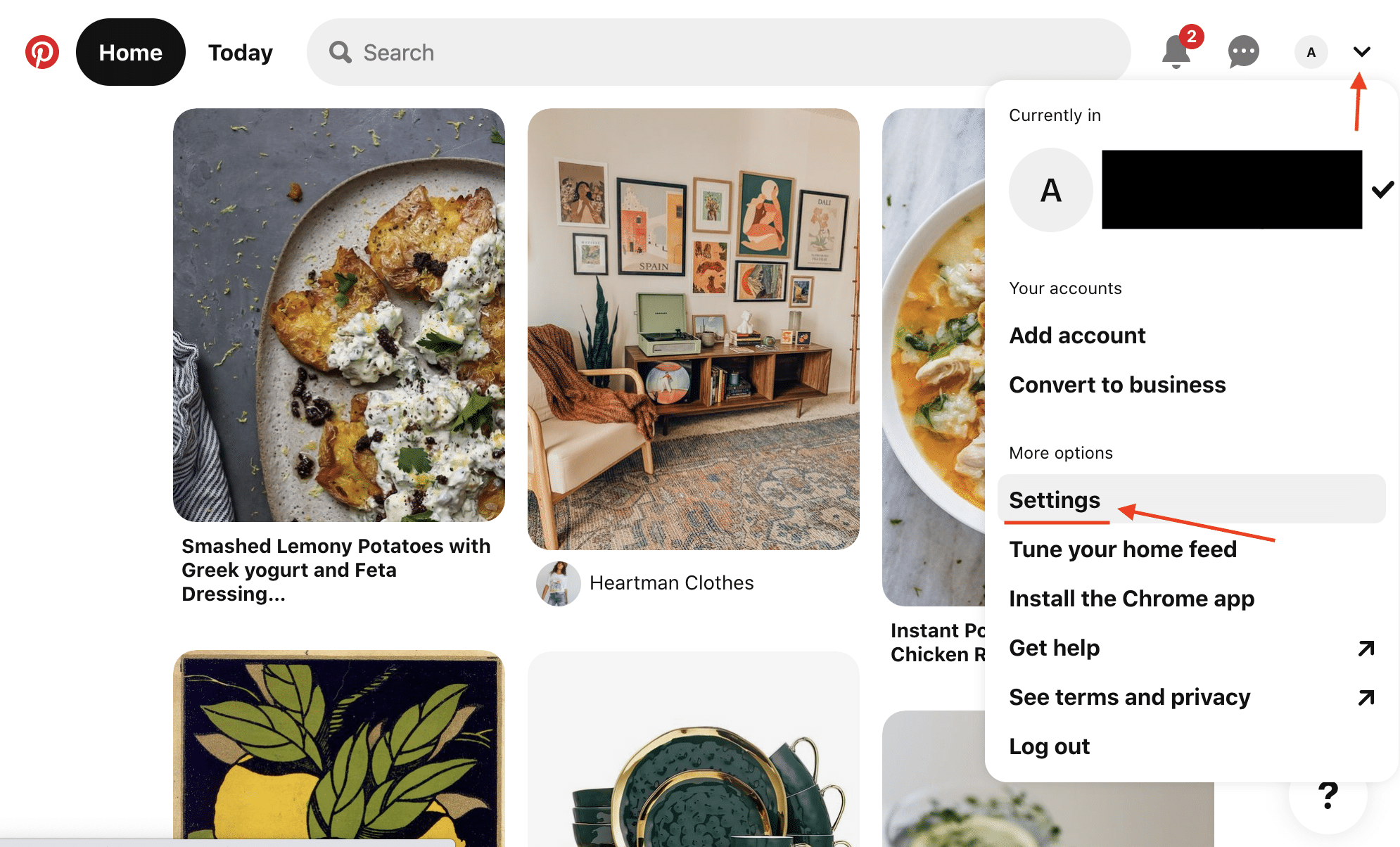

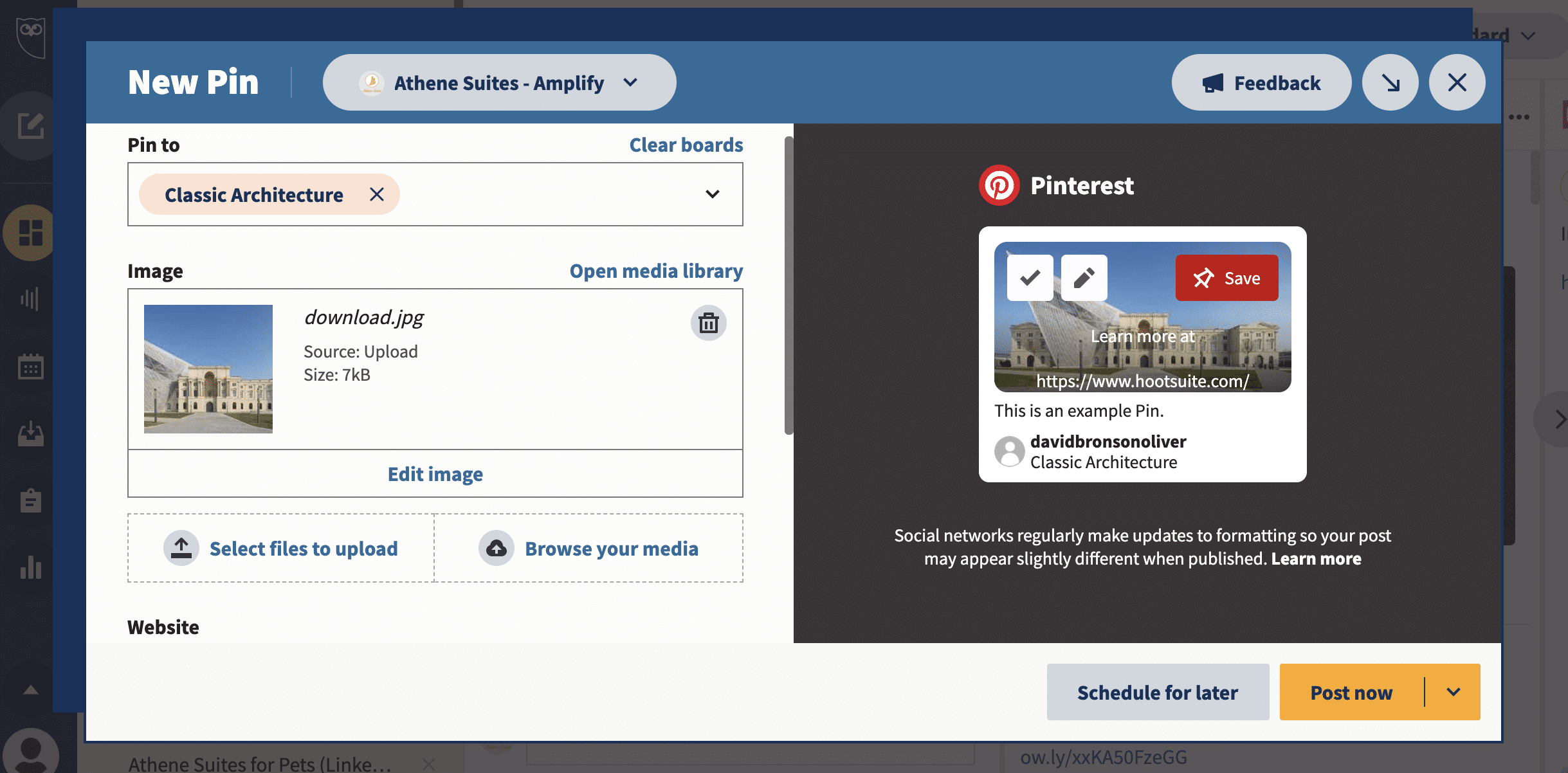

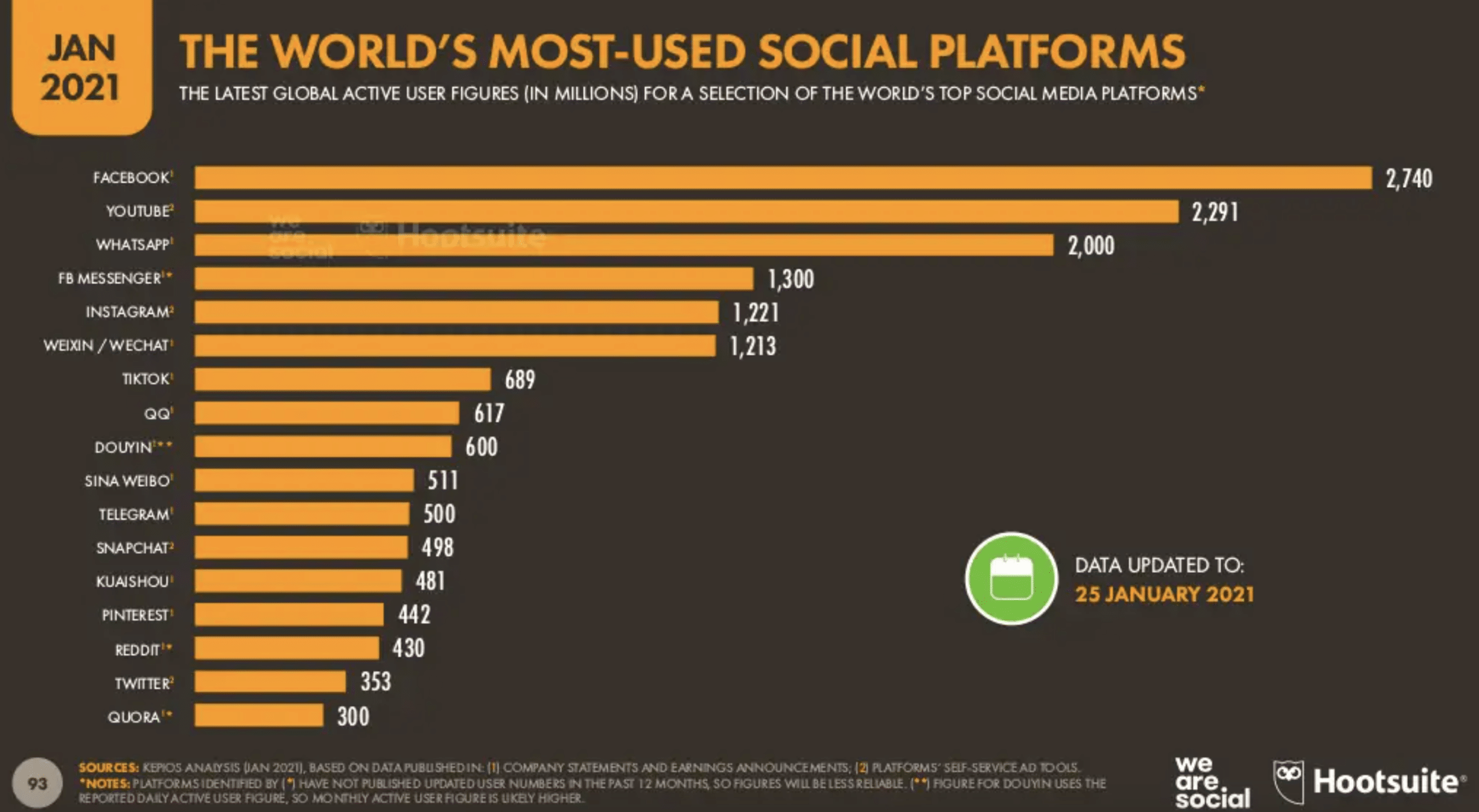

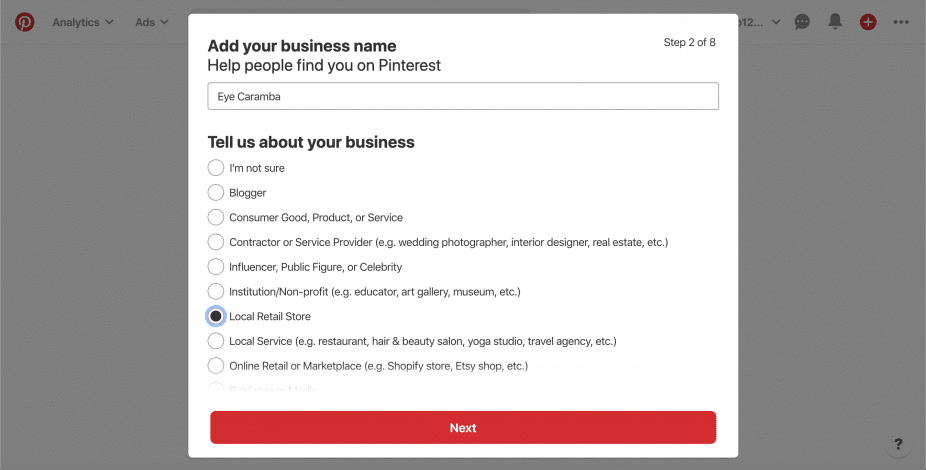

How to Use Pinterest for Business: 8 Strategies You Need to Know In this video I share the 9 steps to set up your sole proprietorship small business in Calif… Are you looking to start your one-person business in California? In this video I share the 9 steps

Source Image: blog.hootsuite.com

Download Image

Sole Proprietorship vs LLC in California – San Diego Corporate Law Feb 27, 2023Check out LLC taxed as Sole Proprietorship for more details. To start an LLC in California, you need to file the Certificate of Formation with the Secretary of State and pay a $200 filing fee. A Limited Liability Company must also pay an LLC annual fee and appoint a Registered Agent in order to stay in compliance.

Source Image: sdcorporatelaw.com

Download Image

The 4 Most Popular Types of Businesses and How To Choose One – Shopify Indonesia A sole proprietorship is simply a Business-of-One. One owner, you, who gets all the assets and profits and takes responsibility for the taxes. It’s the most common way to structure a business if you’re a freelancer, consultant or small business offering services to clients. But it’s not always the best business structure.

Source Image: shopify.com

Download Image

How to Use Pinterest for Business: 8 Strategies You Need to Know Dec 26, 2023Sole Proprietorship Disadvantages. Steps to Start a Sole Proprietorship in California. Step 1: Come Up With a Business Name. Step 2: File the Fictitious Business Name Statment Form. Step 3: Get an EIN. Step 4: Research Business License Requirements.

Source Image: blog.hootsuite.com

Download Image

How to Use Pinterest for Business: 8 Strategies You Need to Know Obtain An Employer Identification Number (EIN) 1. Choose A Business Name. In California, a sole proprietor has the option to use either their legal name or a trade name, also referred to as a “fictitious business name” (FBN) or “doing business as” (DBA), for conducting their business. However, if you decide to use an FBN or trade name

Source Image: blog.hootsuite.com

Download Image

How to Use Pinterest for Business: 8 Strategies You Need to Know They are easy to set up and, for this reason, are popular amongst solo entrepreneurs and startups. Unlike business structures like Limited Liability Companies (LLCs) or corporations, there is no legal separation between the business and the owner. … A step-by-step guide to starting your California sole proprietorship. 1. Choose a business name.

Source Image: blog.hootsuite.com

Download Image

How to Use Pinterest for Business: 8 Strategies You Need to Know

How to Use Pinterest for Business: 8 Strategies You Need to Know Nov 25, 2022Sole proprietorship in California. Sole proprietorships are unincorporated and owned by one person. They’re best suited for smaller businesses with no (or few) employees. Keep in mind, you are not separate from your business. So, while 100% of the profits go to you, you are also 100% responsible for your business’s liabilities.

The 4 Most Popular Types of Businesses and How To Choose One – Shopify Indonesia How to Use Pinterest for Business: 8 Strategies You Need to Know Dec 26, 2023Sole Proprietorship Disadvantages. Steps to Start a Sole Proprietorship in California. Step 1: Come Up With a Business Name. Step 2: File the Fictitious Business Name Statment Form. Step 3: Get an EIN. Step 4: Research Business License Requirements.